kutuzov-bp.ru

Market

Refi To Pay Off Debt

Should You Refinance Your Mortgage to Pay Down Debt? Short answer, it depends. If you're a homeowner with equity in your home, refinancing your mortgage to pay. pay off existing debt obligations to qualify the Borrower for the new. Mortgage. • The Mortgagee is not permitted to make Mortgage Payments on behalf of the. Refinancing allows you to consolidate all of this paperwork and debt into a single monthly bill and payment. Mortgage interest can be tax deductible in some. The Federal Housing Authority (FHA) offers a cash-out refinance option to borrowers looking for needed funds. The program is relatively straightforward, and a. Learn the costs and credit score needed to refinance a mortgage in order to get rid of high-interest credit card debt. Find the best strategy for you. Once the cash-out refinance is approved, Better Mortgage will provide you with checks to pay off the institutions that hold debts you owe, and your Better. A debt consolidation or cash-out refinance, however, is when you refinance your mortgage for more than your current balance and borrow against the equity of. You could look into normal consolidation loans if you can get a favorable interest, or possibly a HELOC so that only that portion of your debt. I don't think you will ultimately end up saving money. The credit card and line of credit could be paid off in a few years, but you will end up. Should You Refinance Your Mortgage to Pay Down Debt? Short answer, it depends. If you're a homeowner with equity in your home, refinancing your mortgage to pay. pay off existing debt obligations to qualify the Borrower for the new. Mortgage. • The Mortgagee is not permitted to make Mortgage Payments on behalf of the. Refinancing allows you to consolidate all of this paperwork and debt into a single monthly bill and payment. Mortgage interest can be tax deductible in some. The Federal Housing Authority (FHA) offers a cash-out refinance option to borrowers looking for needed funds. The program is relatively straightforward, and a. Learn the costs and credit score needed to refinance a mortgage in order to get rid of high-interest credit card debt. Find the best strategy for you. Once the cash-out refinance is approved, Better Mortgage will provide you with checks to pay off the institutions that hold debts you owe, and your Better. A debt consolidation or cash-out refinance, however, is when you refinance your mortgage for more than your current balance and borrow against the equity of. You could look into normal consolidation loans if you can get a favorable interest, or possibly a HELOC so that only that portion of your debt. I don't think you will ultimately end up saving money. The credit card and line of credit could be paid off in a few years, but you will end up.

You can consider consolidating a number of debts by refinancing. Essentially, you could get one long-term loan and one easier-to-manage payment. With a cash-out refinance, the difference in home equity goes to the borrower in cash. Ultimately, this allows the borrower to use that cash to pay off all. Eliminate other debt – Use Cash-Out Refi to pay off credit card debt, car notes, or personal loans. · Debt consolidation – Combine your debt under one single. Refinancing is actually counter productive to getting out of debt, as most people move the debt off credit cards and then pay on the loan AND. A cash-out refinance turns unsecured debts into secured debts, and you risk losing your home if you can't keep up with the new mortgage payments. If market. You'll essentially be consolidating that debt into your new mortgage amount and paying whatever interest rate you locked during your refinance. If an appraisal is required, it must be ordered by PenFed. You will be contacted for authorization and payment prior to ordering. Appraisal fees average $ to. Debt consolidation is the act of using a new loan or a new credit card to pay off multiple debts. For homeowners, one way to consolidate debt is by refinancing. Refinancing typically means negotiating new terms for existing debt, whether that means a lower interest rate or a different payment schedule. Transferring a. By filing for bankruptcy to take care of credit card debt, you are taking away any risk to your home. If you were to refinance your mortgage to pay off credit. If you've been making mortgage payments for a while and have some equity built up in your house, you can take out a new mortgage that covers the outstanding. The goal of refinancing is usually to secure a lower interest rate, which can result in lower monthly payments and save you money over the life of the loan. Refinancing your mortgage replaces your old mortgage with a new mortgage; one with a different principal amount and interest rate. The lender pays off the old. Take control of your finances and consolidate your bills with a refinance from Embrace. A debt consolidation refinance uses the equity in your home to pay off. When you're ready, we're here to help you save anywhere from $$1, a month through our mortgage refinance options. Schedule an online appointment with one. A refinance may be a good opportunity to help you consolidate your debt, stop paying extreme interest rates and potentially lower your monthly expenses over. Mortgages are typically structured to pay off in 15 to 30 years. You may not feel the unsecured debt after you've rolled it into your mortgage, but you'll be. No, after refinancing your home mortgage you will have merely transferred some debt to a mortgaged debt, although the new loan interest rate. With access to more money, you will be better able to manage your debt. Refinancing your first mortgage and taking some existing equity out could also enable. In general, when you refinance to pay off credit card debt or other high-cost debts, your monthly payment goes down. Depending on whether you stick with your.

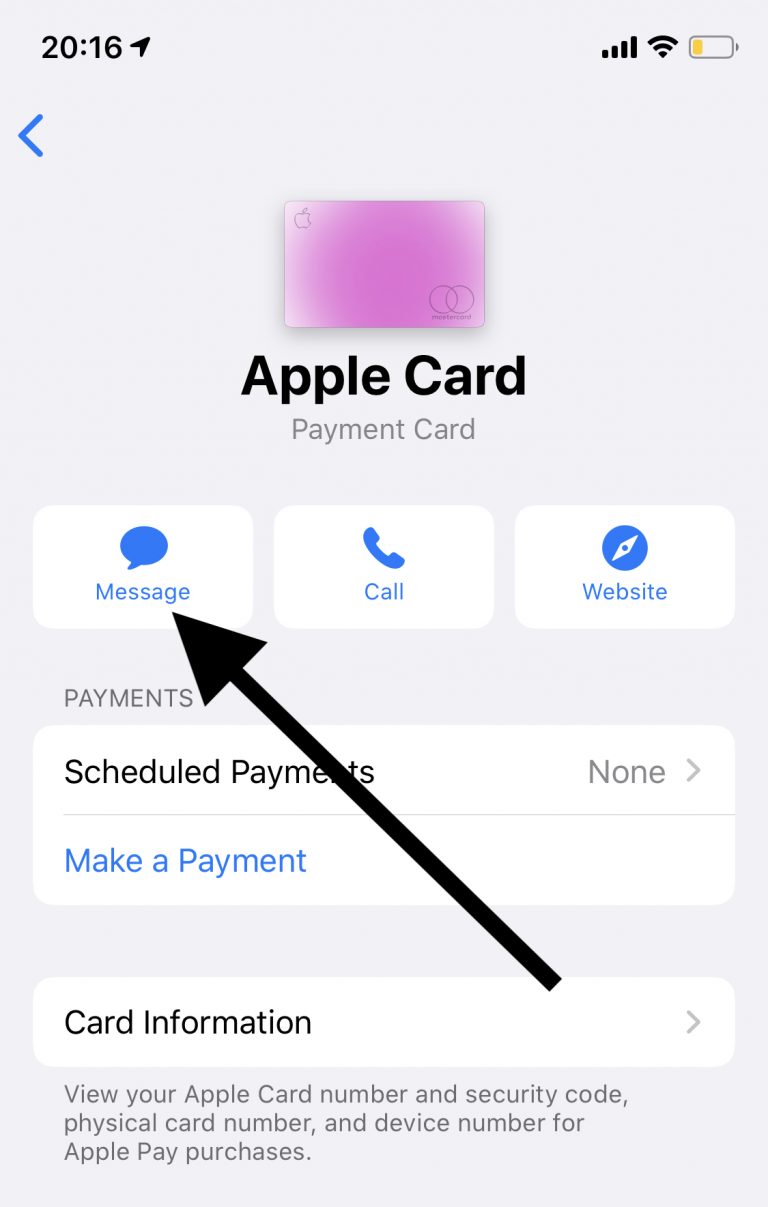

Raise Limit On Apple Card

As Thom says, you dropped your score or made too many applications for credit cards in a 30 day period. This caused Apple to deny your. In theory, you can request a higher credit limit whenever you want. Many card issuers make it easy by allowing for increase requests on their website portals. You can also set a calendar reminder and request a credit limit increase in six months. Can your credit limit decrease as a result of the credit limit increase request? App Store and the Apple Logo are registered trademarks of Apple Inc. Card issuers can change your credit limit without notice. There are a number of protections in place to ensure that your card issuer does not unfairly increase. How can I increase my credit card limit? Please contact a loan officer in person or by phone to request a credit increase. If you're interested in increasing your credit limit, you can make a request after you've had your Apple Card for as little as four months. Simply call or text. To request a change to your credit limit, visit the Manage Accounts tab, click Payment and Credit Options and click Change Credit Limit. There's no magic solution for getting more credit, but there are plenty of helpful strategies that can get your increase request approved. As Thom says, you dropped your score or made too many applications for credit cards in a 30 day period. This caused Apple to deny your. In theory, you can request a higher credit limit whenever you want. Many card issuers make it easy by allowing for increase requests on their website portals. You can also set a calendar reminder and request a credit limit increase in six months. Can your credit limit decrease as a result of the credit limit increase request? App Store and the Apple Logo are registered trademarks of Apple Inc. Card issuers can change your credit limit without notice. There are a number of protections in place to ensure that your card issuer does not unfairly increase. How can I increase my credit card limit? Please contact a loan officer in person or by phone to request a credit increase. If you're interested in increasing your credit limit, you can make a request after you've had your Apple Card for as little as four months. Simply call or text. To request a change to your credit limit, visit the Manage Accounts tab, click Payment and Credit Options and click Change Credit Limit. There's no magic solution for getting more credit, but there are plenty of helpful strategies that can get your increase request approved.

Increase Credit Card Limit If you already have a credit card with us, you can request an increase to your credit card limit by stopping by an office or over. But, you are new to this and feeling restricted by your Apple Card limit? Or do you think it would be helpful to raise your spending limit on. To Temporarily Change your daily limits in Online Banking: · Sign in to Online Banking · From the Account Summary screen, scroll down and select Daily Transaction. Card Limit Increase & Upgrade · Log in to Web Branch/App · Click 'Manage Cards' · Find the Credit Card and click 'Upgrade or Increase Limit' to continue. Yeah, Apple does this on the regular. Seems like about every six months or so I get a notification. it technically won't hurt you. In all. You can request a change in your credit card limit by visiting any BluPeak Credit Union branch or calling Increasing your credit limit isn't. Apply. Don't have an Apple Visa? Request a transfer during the application process. Apply Now · Transfer. Use Card Manager in Apple FCU Online or Mobile, or call. Attempts to raise the limit w/ Goldman Sachs (who I understand have never done consumer credit cards until now) hit a deadend as the card is too new. The. This question was, do they increase it by itself or after a while? So this is referring to the Apple Card credit limit? The apple. The Apple Card limit on your. Apple Branded iPhone Leather Wallet with MagSafe. One can also bundle devices, like an Apple Pencil and iPad, increasing the installment plan to 12 months. Apple, the Apple logo, Apple Pay, Apple Watch, Face ID, iCloud Keychain, iPad, iPad Pro, iPhone, iTunes, Mac, Safari, and Touch ID are trademarks of Apple Inc. You can request a credit card credit limit increase through Card Center in Digital Banking. We'll pull your current credit report and adjust the available. Log in to Web Branch to easily request a credit limit increase for your UWCU credit card. Select your credit card account, go to the Details tab, and click on. I'm going to teach you how to get a credit limit increase on your Apple credit card every three months. Understand that this is one of the very few credit cards. Do you need access to a higher credit limit? Sign in your account to view your eligibility and request a credit limit increase. Request an increase to your credit card limit. Reduce the amount you can Apple, the Apple Logo, Apple Pay, iPhone, Apple Watch and Touch ID are. Card issuers may consider a variety of factors, such as your past payment history, when deciding the risk of approving an over-the-limit transaction. Any. Call your credit card company. The back of your card has a customer service number you can call and learn if you're eligible for an increased limit. You may. Sometimes, your credit card company will increase your credit limit automatically. When this occurs, you'll receive a notification letter detailing the increase.

Pacific Sothebys International Realty

Pacific Sotheby's International Realty. pacificsothebysrealty. posts. $$$$. + · TopRecentIn the area · Beyonce, Leonardo DiCaprio, Tyler Perry. Represented HOM Sotheby's (“HOM”) in connection with its sale to San Diego-based Pacific Sotheby's International Realty, thereby creating one of the world's. Pacific Sotheby's International Realty was founded in as a residential brokerage, specializing in the luxury Southern California market. Locally owned and operated, Pacific Sotheby's International Realty is one of the top luxury real estate firms in Southern California. Pacific Sotheby's. Pacific Sotheby's International Realty provides comprehensive real estate services in Southern California. Locally owned and operated, the company provides. View Real Estate Agents at Pacific Sotheby's International Realty Located at Womble Road # San Diego, CA Find real estate agency Pacific Sotheby's International Realty in Newport Beach, CA on kutuzov-bp.ru®, your source for top rated real estate professionals. Check out how verified property buyers and sellers rate their experience with Pacific Sotheby's International Realty. PACIFIC SOTHEBY'S INTERNATIONAL REALTY in Carlsbad, reviews by real people. Yelp is a fun and easy way to find, recommend and talk about what's great and. Pacific Sotheby's International Realty. pacificsothebysrealty. posts. $$$$. + · TopRecentIn the area · Beyonce, Leonardo DiCaprio, Tyler Perry. Represented HOM Sotheby's (“HOM”) in connection with its sale to San Diego-based Pacific Sotheby's International Realty, thereby creating one of the world's. Pacific Sotheby's International Realty was founded in as a residential brokerage, specializing in the luxury Southern California market. Locally owned and operated, Pacific Sotheby's International Realty is one of the top luxury real estate firms in Southern California. Pacific Sotheby's. Pacific Sotheby's International Realty provides comprehensive real estate services in Southern California. Locally owned and operated, the company provides. View Real Estate Agents at Pacific Sotheby's International Realty Located at Womble Road # San Diego, CA Find real estate agency Pacific Sotheby's International Realty in Newport Beach, CA on kutuzov-bp.ru®, your source for top rated real estate professionals. Check out how verified property buyers and sellers rate their experience with Pacific Sotheby's International Realty. PACIFIC SOTHEBY'S INTERNATIONAL REALTY in Carlsbad, reviews by real people. Yelp is a fun and easy way to find, recommend and talk about what's great and.

Pacific Sotheby's International Realty (A Peerage Company) is a brokerage located in San Diego, CA. They are a Sotheby's International Realty affiliate and. Pacific Sotheby's International Realty, Prospect St Suite , La Jolla, California, , United States, O: +1 Check out how verified property buyers and sellers rate their experience with Pacific Sotheby's International Realty. Explore Real Estate listings Pacific Sotheby's International Realty in United States. One of + sellers represented on the World's Largest Luxury. Pacific Sotheby's International Realty is a full-service real estate company serving all of San Diego County and Orange County regions. Find all information about Pacific Sotheby's International Realty luxury real estate agency in San Diego (United-States). Les coordonnées et la présentation. Built on centuries of tradition and dedicated to innovating the luxury real estate industry, Sotheby's International Realty offers transformative experiences. A Southern California real estate firm covering miles of pristine coastline. DRE# Pacific Sotheby's International Realty is part of Apollo Global Management, Inc. They spent under $ million on advertising in digital and print in the. Pacific Sotheby's International Realty: Luxury Real Estate Agent in Rancho Santa Fe, United States. 0 Properties for sale and for rent. Pacific Sotheby's International Realty, San Diego, CA. 1 like · 40 were here. Real Estate Agent. Pacific Sotheby's International Realty is using Eventbrite to organize upcoming events. Check out Pacific Sotheby's International Realty's events. Pacific Sotheby's International Realty is a Real Estate, Luxury Real Estate, and Oceanfront Properties company_reader located in San Diego, California with. Pacific Sotheby's International Realty has an overall rating of out of 5, based on over 25 reviews left anonymously by employees. 89% of employees would. Find all information about Pacific Sotheby's International Realty luxury real estate agency in Solana Beach (United-States). Find all information about Pacific Sotheby's International Realty luxury real estate agency in San Diego (United-States). Les coordonnées et la présentation. Pacific Sotheby's International Realty will help you find a coastal home in San Diego, La Jolla, Point Loma, Coronado, Del Mar, Carlsbad, Encinitas. Looking for a luxury real estate brokerage in Rancho Santa Fe Connect with our team of experienced agents at Pacific Sotheby's International Realty. Get more information for Pacific Sotheby's International Realty in Carlsbad, CA. See reviews, map, get the address, and find directions. 22 Faves for Pacific Sotheby's International Realty from neighbors in San Diego, CA. Connect with neighborhood businesses on Nextdoor.

Best Credit Cards For Young Couples

The best credit card for couples is the PNC Cash Rewards® Visa® Credit Card because it's one of the best cash back cards on the market and PNC allows joint. “Since money is a top source of stress in relationships, I advise couples who are seriously dating — especially young couples — to schedule regular Money Date. CapitalOne Venture is my go-to card. We have gotten money back for flights, hotels, vacation excursions, airport baggage costs, etc. Best for a low deposit: Capital One Platinum Secured Credit Card Here's why: With the Capital One Platinum Secured Credit Card, you may qualify for an opening. Best Travel Credit Cards. View Guide. Credit Card Recommendations. Best 0% APR A young woman holding a credit card while using a cellphone at home. True Link's Visa® Prepaid Card offers financial protection and independence for older adults, people with disabilities, and people in recovery from. Best credit for couples who love to travel: Chase Sapphire Preferred® Card · Best credit card for couples, with no annual fee: Wells Fargo Active Cash® Card. Young couple look at good news on smartphone. How long does it take to get a credit card? Bankrate's image file. Read more about credit card basics. Explore. Hands down, the Chase Sapphire Preferred® Card is our absolute favorite travel buddy. And it'll likely be yours, too. There's an $95 annual fee, which is easily. The best credit card for couples is the PNC Cash Rewards® Visa® Credit Card because it's one of the best cash back cards on the market and PNC allows joint. “Since money is a top source of stress in relationships, I advise couples who are seriously dating — especially young couples — to schedule regular Money Date. CapitalOne Venture is my go-to card. We have gotten money back for flights, hotels, vacation excursions, airport baggage costs, etc. Best for a low deposit: Capital One Platinum Secured Credit Card Here's why: With the Capital One Platinum Secured Credit Card, you may qualify for an opening. Best Travel Credit Cards. View Guide. Credit Card Recommendations. Best 0% APR A young woman holding a credit card while using a cellphone at home. True Link's Visa® Prepaid Card offers financial protection and independence for older adults, people with disabilities, and people in recovery from. Best credit for couples who love to travel: Chase Sapphire Preferred® Card · Best credit card for couples, with no annual fee: Wells Fargo Active Cash® Card. Young couple look at good news on smartphone. How long does it take to get a credit card? Bankrate's image file. Read more about credit card basics. Explore. Hands down, the Chase Sapphire Preferred® Card is our absolute favorite travel buddy. And it'll likely be yours, too. There's an $95 annual fee, which is easily.

While the American Express Essential Credit Card comes with the additional benefit of letting you earn rewards points on every dollar spent on purchases. One-. Natwest Purchase and Balance Transfer Credit Card, £0, 19 months interest-free for purchases and balance transfers (must be made within the first 3 months, Purchase & Balance Transfer card. Good for - time to pay off purchases and balances. 0% on purchases. Designed specifically for people with low credit scores, our best credit cards for bad credit can help you rebuild your credit score. Representative % APR. Best couples credit cards · Best for groceries: Blue Cash Preferred® Card from American Express · Best for cash back: Citi Double Cash® Card · Best for building. UW Credit Union offers comprehensive financial services from Madison to Milwaukee including checking and savings accounts, credit cards, mortgages. UW Credit Union offers comprehensive financial services from Madison to Milwaukee including checking and savings accounts, credit cards, mortgages. My favorite rewards credit cards · Fidelity Rewards Visa Signature · Fidelity® Rewards Visa Signature® Card · Amex Blue Cash Preferred® Credit Card · Blue Cash. What are your debts (including credit cards)?. Most people would like to enter marriage debt-free. And if you can do so, hooray for you! But the majority of. No, getting married does not have any affect on your credit. Credit reports do not record marital status. Credit scoring systems, which calculate scores using. The best credit cards for young adults make learning to manage credit easy with simple card features and low fees. The Petal 2 Visa Credit Card is the best credit card for young adults because it combines low costs with high approval odds and generous rewards. Best credit cards for couples · #1: UOB One Card · #2: Maybank Family & Friends Card · #3: KrisFlyer UOB Credit Card · #4: HSBC Revolution Credit Card. ✓ COUPLES GAMES DATE NIGHT IDEAS: Best Self Intimacy card game ✓ CONVERSATION CARDS FOR COUPLES: Looking for date night games for young 2 players? Best Travel Credit Cards. View Guide. Credit Card Recommendations. Best 0% APR A young woman holding a credit card while using a cellphone at home. Looking for the best credit cards for young adults? Read MoneySmart's comparison for options that offer rewards, no annual fees, and financial flexibility. Bank of America Premium Rewards credit card · Delta SkyMiles Platinum American Express Card · Capital One Venture X Rewards Credit Card · Chase Sapphire Reserve. Get out of debt with The National Foundation for Credit Counseling, a non-profit trusted network of credit counseling agencies. Connect with a counselor! If you are routinely maxing out your credit cards, for example, you may be headed for trouble. What is a good credit utilization ratio? For the purposes. With an Alphaeon Credit card, you'll find a wide array of monthly payment options to help you be your best you. With special financing options.

2 3 4 5 6